Starting a company is exciting, but let’s face the truth: sometimes obtaining finance is the biggest challenge.

Fortunately, 2025 is bringing more options than ever in terms of funding, be it launching a neighborhood coffee company or establishing a software platform.

Here’s how to fund your ambitions.

Table of Contents

Bootstrapping: The DIY Approach

Founders of some of the biggest companies used their savings, reinvested revenue, or used credit cards to fund their ventures. It is risky, but gives one full control. If your startup is service-based or if you have a low-cost business plan, whether it is building an investment platform or similar, then self-funding may be your best option.

Keeping almost complete control of your business with self-funding lets you test your idea with no pressure from outside. However, it also means taking all the financial risks yourself.

Starting small is one way to make bootstrapping work. From day one, concentrate on cash generation, keep costs to a minimum, and plow back any profits into the firm. Many entrepreneurs began small as side projects that grew full-time. Be frugal and think strategically when putting your money to work.

Such things as embracing digital technology, automating processes, and outsourcing non-essential work will go a long way toward conserving your cash.

Friends and Family: Your Inner Circle

One of the common early-stage financing methods is approaching personal networks. The trick is to make it a business transaction. Write contracts, spell out repayment terms, and have reasonable expectations.

Although an investment from a cousin may seem like an informal agreement, making it professional avoids problems down the line.

It is also important to make sure that your loved ones are aware of the risks. Not all startups are successful, and you don’t want your personal relationships to suffer in case something goes awry.

You can prevent misunderstandings by explicitly setting out repayment plans or by freely offering equity.

Convertible notes, whereby early investors can subsequently convert their investment into stock at a discounted rate, are a route chosen by some entrepreneurs.

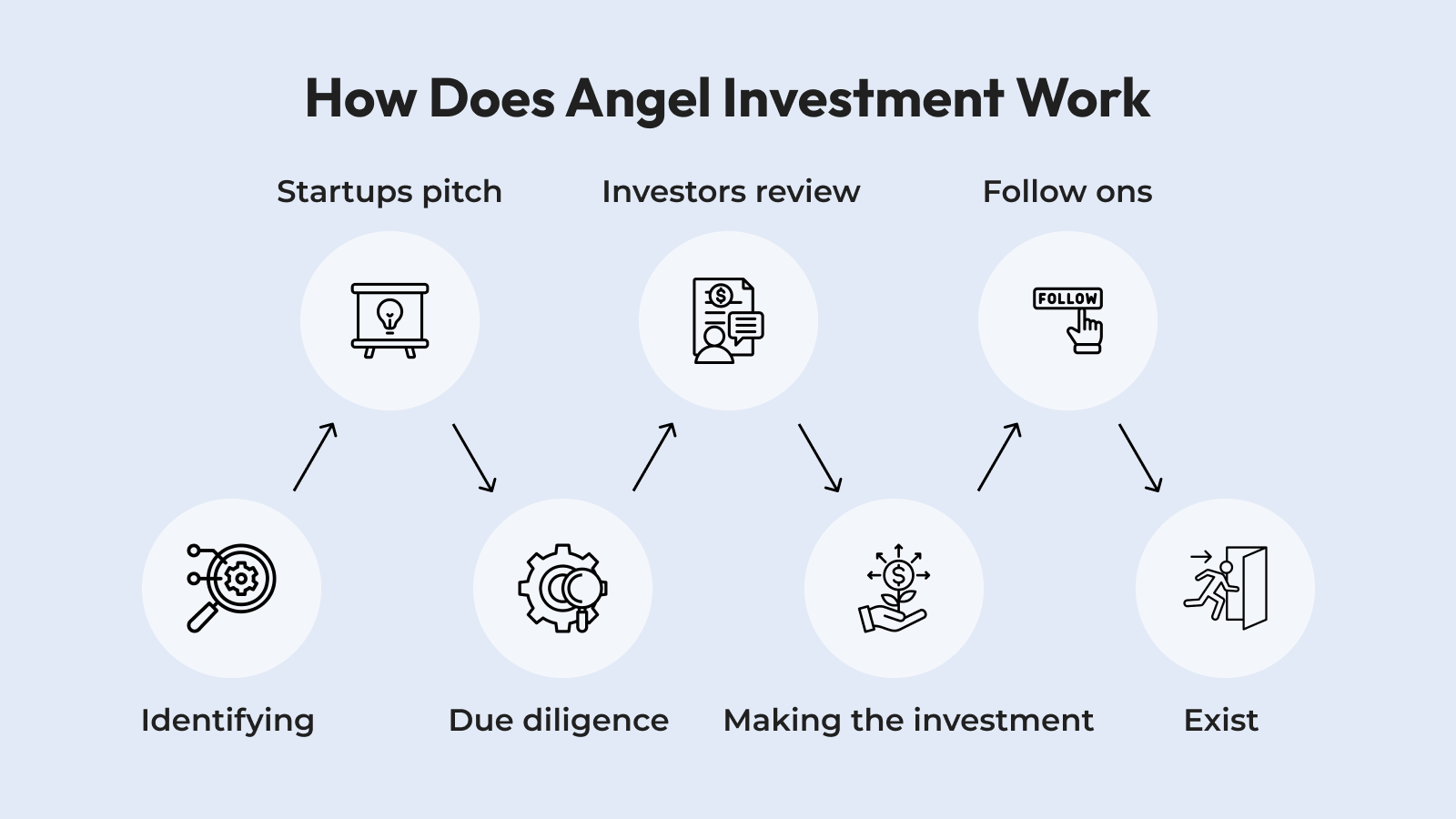

Angel Investors: Early Backers Who Believe in You

Successful investors who want to invest in great companies can do so in return for equity. They invest earlier and tend to have a more controlling attitude compared to venture capitalists.

Networking with contacts on AngelList, pitch nights, or LinkedIn might present opportunities.

Other than their financial inputs, angel investors offer business connections, guidance, and experience, which is of immense benefit. Through investments in the next generation of businesses, many successful entrepreneurs end up being angel investors as well.

Thanks to AI-based investor matching services, finding the proper backers has never been more convenient in 2025.

Venture Capital: Scaling Fast With Big Money

Venture capitalists (VCs) look for high-growth potential startups. With the expectation of a high return, they invest large sums in return for equity. Venture capitalists can assist you in expanding your business rapidly if it is scalable or technology-based.

Be prepared to be under the microscope and pressured to deliver results fast, however.

You will need a strong team, a clear growth target, and a well-written business plan to gain venture capital financing. In some form of user growth, revenue, or validation of the market, investors will need to witness traction.

As much as it is a competitive process, an investor who has the right background can give you the financial and strategic resources that you need to move your business forward.

Demo days, startup competitions, and accelerator programs are some of the ways most entrepreneurs raise funds.

Government Grants and Programs: Free Money (With Strings Attached)

Governments worldwide encourage entrepreneurship through grants, tax credits, and startup accelerators.

Deep-tech startups, sustainability, and AI are the buzz in 2025 investment. Look into local and global programs—you may be eligible for non-dilutive funding that does not equate to giving away equity.

Though grants are attractive since they must not be repaid, they have stringent requirements, i.e., research milestones or employment targets.

Read the application and reporting provisions carefully prior to entertaining this choice. Some governments also give low-interest loans and subsidies to early-stage start-ups.

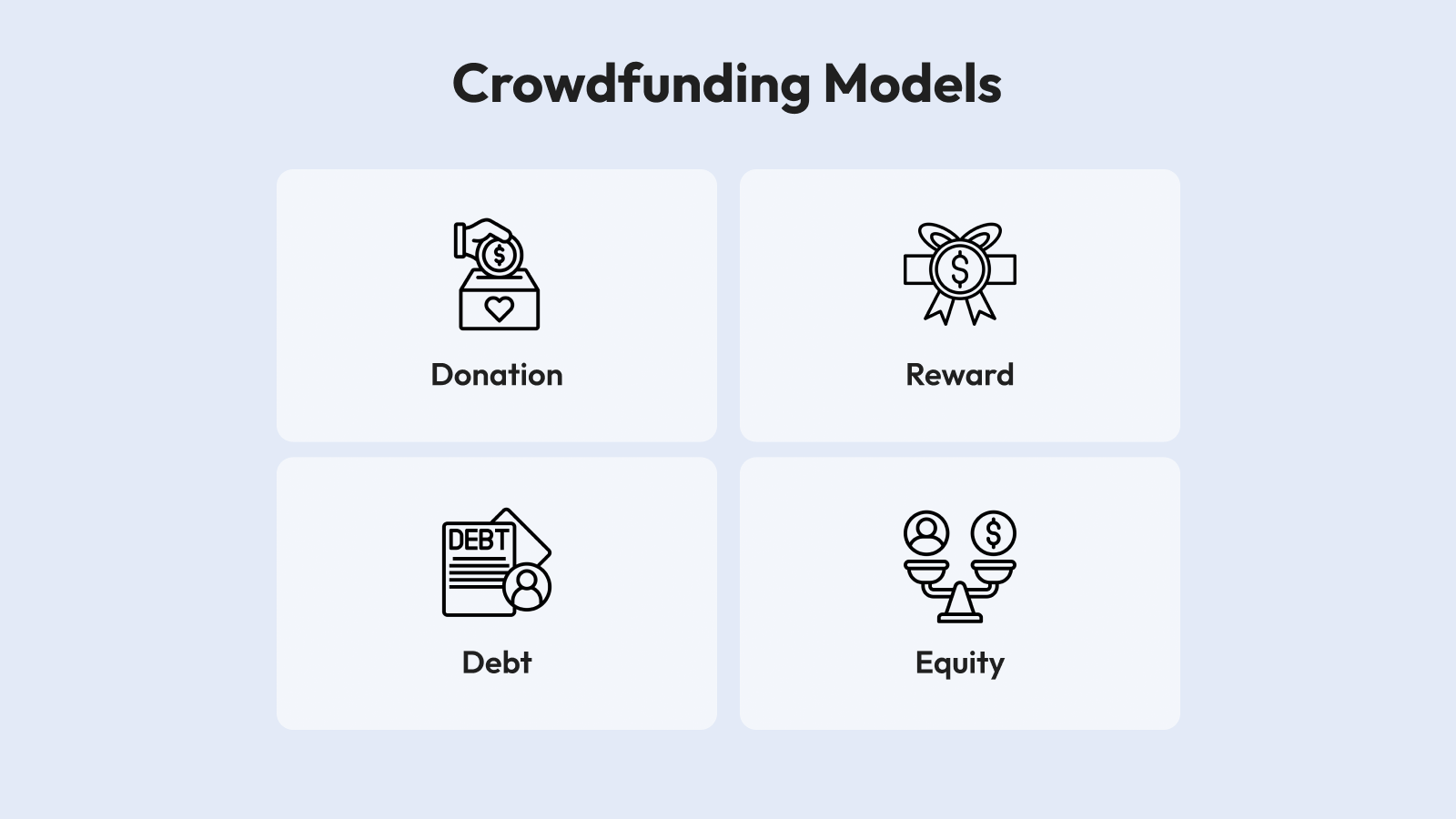

Crowdfunding: Let the Public Fund Your Idea

Platforms such as Kickstarter and Indiegogo allow startups to raise money directly from consumers. It is ideal for consumer goods, creative ventures, and cause-oriented startups.

If your idea is on trend, thousands of followers may fund it even before you begin.

Crowdfunding is also a great demand validation technique. If others are willing to pay for your product prior to it being available, that’s a great indication that you have something valuable.

To be successful at crowdfunding, though, you must promote, tell a good story, and have a fulfillment plan. Social media activity and influencer partnering can build awareness and bring in additional backers.

Revenue-Based Financing: Pay As You Earn

Instead of giving up equity, some founders seek revenue-based financing. Lenders invest in return for a percentage of future revenue. If your startup has already gained some sales traction, this is a flexible alternative to traditional loans or VC investment.

This is a suitable structure for companies with consistent cash flows, like subscription companies or e-retailers.

This enables founders to grow the company without incurring a lot of debt or equity dilution. As of 2025, fintech lenders have made this sort of funding increasingly common, providing AI-powered underwriting to accelerate approvals.

Corporate Partnerships: Strategic Funding With Industry Leaders

Large corporations like to invest in synergistic startups.

Direct investment, joint ventures, or acquisition deals, whichever, being aligned with a market leader can provide capital along with credibility.

For instance, a health tech AI diagnostic startup could be invested in by a large healthcare company. The startup receives funds and industry contacts, and the company receives innovative technology.

Incubators that offer capital, office space, and mentorship to innovative startups are also present in most companies.

Bank Loans and Alternative Lending

Online lenders and fintech companies have made small business financing easier, but traditional banks are still hesitant when it comes to startups. You can get a loan without sacrificing ownership if your finances and business plan are well established.

By 2025, digital lending platforms will simplify capital raising for businesses by providing tailor-made loan solutions depending on a borrower’s personalized assessment through AI.

Even hybrid funding solutions, which mix aspects of revenue-based finance with conventional loans, are being provided by some lenders. Business credit lines and microloans are also being utilized by early-stage companies more often.

Startup Competitions and Accelerators

Going through an accelerator or pitching in entrepreneurial contests can provide opportunities for networking, financing, and guidance from experienced mentors.

By participating in programs like Y Combinator, Techstars, and other regional accelerators, startups are able to refine their business models and receive seed funding.

Though some financial assistance and investment for such projects may occasionally require equity, the long-term benefits can eclipse the start-up expenses. The genesis for numerous prosperous companies, including Dropbox and Airbnb, was in accelerator programs.

Startups get more than just capital; they also gain access to investor networks, workspace, and guidance.

Fundraising Errors That Could Destroy Your Startup

Fundraising is one of the most important stages of any startup. Making the wrong choices at this stage can ruin your chances of success, but securing the perfect investment can send your company soaring to new heights.

Fundraising mistakes can cause your startup to fail completely, besides setting it back. In this piece, we cover fundraising pitfalls and offer practical tips on how to steer clear of them.

Overvaluing your startup

A lot of entrepreneurs overvalue their startup because they are so incredibly enthusiastic about its potential. Confidence is key, but investors could be put off by a frothy valuation.

You’re your startup, and you overprice yourself, investors see a red flag. They may think you are inexperienced or that you don’t know your market. Exaggerated Valuations often suggest you didn’t do the necessary work to gauge accurately the market and your own competitive position.

Focus on your property’s valuation is a street that is solid and sensible. Investors are expecting that you will bring statistics (size of the market, the history, revenue projections, businesses in comparison, etc) to prove the value of your company.

Cushion your valuation with substantial market research and financials. Remember that a fair value serves as proof that you know you’re market and strategy for growing wisely.

Ignoring due diligence

Investors have a process, known as due diligence, that they follow prior to making a financial commitment. You are going to get poked and prodded with everything from financial documents and contracts to marketing plans and customer acquisition strategies.

If your financials are not in order, or not organized, or incorrect, investors will think that you won’t be able to manage the financials. If the legal documents are disorganized or non-existent, it could be indicative of risk and uncertainty.

“The same way that a poorly written business plan, or a business plan that doesn’t express itself, raises questions for somebody in front of all of us, it makes investors wonder if you can grow this company,” he adds.

Ensure your paperwork is done, including contracts, patents, IP agreements, and financials, so there is no way you can make this mistake. Be up front and candid about any problems or weaknesses in your company and demonstrate how you are addressing them. Some coat and tie in your due diligence package, and show investors you are serious and professional.

And working with good legal and financial counsel during due diligence is also a way of doing it more quickly, solving issues upfront, and making sure you don’t miss anything.

Focusing only on money

It is quite easy to become fixated on raising capital, but if you treat fundraising as an event, it will fundamentally damage your business. Business growth comes with a cost; however, the improper approach to investors can create misalignment, opportunity costs, and weak partnerships.

Investors look beyond just offering their money; they want to see the passion that goes into preparing the vision and the action plan for setting it in motion and successfully realizing it. Understanding the true intent of the situation, that the person is really trying to run a business and not just asking for cash, puts him in a more willing and positive position.

Moreover, it’s worth bearing in mind that investors are not limited to providing cash alone. They can help you get from point A to B, also aiding you with connections in the industry, as well as in the form of strategy, guidance, and mentorship. A good investor goes beyond simply waiting for ROI. They become a partner helping the firm succeed with their funds.

To attract the best-suited investors, ensure you are aligned with the right people who share your goal. Draft a powerful pitch that explains your passion so as to be able to book favorable investors who actually care about the project in question.

Not having a clear plan for the funds

Many businesses working on fundraising often make the same mistake: they lack a coherent, thorough strategy for the distribution of the money raised. Investors want to see that their money is being put to good use and driving the development of your firm. If you can’t show how the money will be allocated and how it will help you meet your goals, investors are probably not going to trust you with their money.

Without a clear plan, your fundraising attempts could appear random, and investors might question whether you have a strategy for expansion. The lack of a specific plan for distributing the money raises questions about whether they are necessary or just a broad cash grab.

Draft a detailed financial plan detailing your exact spending schedule to help avoid this mistake. Divide it into sections, each on technological developments, team expansion, marketing and sales strategies, product development, and operating costs.

Every cost ought to have a direct bearing on the growth and prosperity of your business. A well-defined financial plan gives investors confidence that you grasp capital management and are committed to its effective application.

Be also ready to adjust your financial plan as your company grows. Flexibility in your financial plan could show investors that you have the capacity to change course should circumstances call for it.

Taking the wrong investment

Not every investor would suit your business. Many founders overlook, in their rush to seek money, how important it is to pick investors who share the values, goals, and culture of their firm. Funding from an investor who disagrees with your vision could cause major problems down the road.

For instance, an investor who disagrees with the pace of your company could push you to adopt policies that clash with your company’s values, resulting in stress and poor judgment. Misalignment may lead investors to try to take over decision-making, which might eventually harm your company.

Another challenge is accepting money from investors with a history of being difficult to work with or who seek a level of control you find objectionable. Just as they do you, it is essential to carefully evaluate investors. Determine their investment philosophy, how active they want to be in your company, and whether they have experience in your sector.

To prevent making this mistake, spend some time getting to know potential investors and ensure they share your long-term objectives. Look for investors who share your goals and who can offer more than simply money. Long-term success depends on a strong, constructive relationship with your investors.

What is the Right Approach?

Most successful companies draw on several of these funding streams. Choose answers fitting your long-term objectives, degree of risk, and corporate stage. Whether you decide to crowdfund, seek venture funding, or bootstrap, 2025 presents more possibilities than ever to realize your vision.

The most vital lesson: Build the financial basis your business needs to succeed by being persistent, applying strategic judgment, and drawing on several funding sources. The right financial strategy will help to distinguish a company with international reach from a notion lingering on paper.

This is a guest post written by Yuliya Melnik

Yuliya Melnik is a technical writer at Cleveroad, a software development company that offers software development for startups. She is passionate about innovative technologies that make the world a better place and loves creating content that evokes vivid emotions.

If you want to submit guest posts to Inuidea, check out the guest post guidelines for Inuidea.com. If you have any questions or if you wanna work with me, feel free to contact me. I’m always available to help young hustlers like you!

Leave A Comment