You wish to start an online fintech business.

And why not?

After all, it is one of the most profitable industries in today’s digitally driven world

Capitalizing on this opportunity in the financial industry seems like the most natural choice.

Whether you’re an experienced financial professional or a tech-savvy entrepreneur, creating a successful online fintech business requires careful planning and innovative ideas.

In this blog post, we’ll explore all the essential aspects related to a fintech startup, including identifying your target market, choosing the right technology, etc.

So, if you’re prepared to shake up the financial industry and establish a successful online fintech venture, let’s get started!

What NOT to do

1. Do NOT Overlook Regulatory Compliance

The fields of fintech and banking are subject to extensive regulation.

So for obvious reasons, it is essential to have a thorough understanding of this intricate sphere.

It includes regulatory bodies, laws, legal restrictions, and mandatory requirements. With the implementation of the GDPR in Europe or with the upcoming data protection law in India, these aspects have gained even more importance.

Fintech regulations may involve anti-money laundering (AML) policies or Know Your Customer (KYC) compliance requirements.

In addition, digital certificates and Adhaar authentication mechanisms may also be necessary.

It is important to consider that law can vary from country to country. Every region is governed by its own unique set of laws.

Therefore, knowing how to navigate the nuances of different legal systems should be your primary focus.

For example, countries such as Mexico and the UAE mandate that firms obtain specific market regulations for fintech licenses, whereas the United Kingdom requires standard licenses.

2. Fintech Subdomains Are Important

There are numerous subdomains you can explore some of which are mentioned below:

- Data analysis and financial decision-making

- Crowdfunding

- Insuretech

- Lending

- Payments and international money transfers

- Financial products

- Cryptocurrencies and blockchain-based solutions

- Trading and investments

- Personal finance management

- Mobile banking

Your fintech product should also cater to a particular audience, such as a specific country or demographic group.

Pro Tip: Do not put all your eggs in one basket at one time. Period. As an entrepreneur, focus on starting your fintech for the local market and then expand to the global market at a later stage if deemed necessary.

3. Ignoring Competition Is Unwise

After selecting your niche, it’s absolutely important to research your competitors.

This will allow you to identify a competitive value that sets your product apart.

In fintech, there are many business opportunities, such as creating a new product or improving an existing service.

Follow a well-established process for the same.

- Assess user experience.

- Share your ideas with as many potential customers as possible

- Successful fintech companies like Mint prioritized creating highly personalized UI/UX that hit their target audience in the right way.

4. Not Focusing On Your Team

The right people will produce the right results.

Not focusing on setting up the right team could be one of the biggest mistakes you’d be making.

However, attracting top financial app developers and building an on-site team can be challenging.

Additionally, experienced engineers in your country can be expensive.

Therefore, startups should consider hiring a software development team offshore, such as in Eastern Europe, Asia, and specifically India.

These can provide access to skilled specialists in a specific domain at a reasonable cost.

5. Tech Stack Is EVERYTHING

To develop complex fintech products, custom software development is absolutely essential.

Third-party CMSs or frameworks cannot handle all the necessary transactions.

The tech stack used by most software providers for fintech app development typically includes the following:

Databases:

- Redis

- MySQL

- MongoDB

- PostgreSQL

Programming languages:

- C/C++,

- Python,

- Java

- Javascript

- Ruby.

Frameworks:

- Spring.

- Node.js,

- Django

- React,

6. Not Prioritising Data Protection

When money is involved, security and privacy are everything.

No matter how good or bad your product is, the one thing a fintech app cannot risk is security breaches.

This means encrypting and securely storing sensitive data in the cloud should be your firm’s no.1 priority.

To ensure this, perform thorough testing of your source code to identify and address any vulnerabilities.

Additionally focus on the following:-

- Use transport layer security (TLS) for network connections, prevent unauthorised API connections,

- Protect client information with HTTPS SSL certificates.

- Choose a secure cloud platform like AWS to protect against DDoS attacks

- Backup data in case of network disruptions.

- Implement multi-step authentication that requires customers to use strong passwords.

- Integrate biometric authentication methods such as face recognition and fingerprint scanning for advanced data protection.

7. Focus On Funding

It could be bootstrapping or taking bank loans or crowdsourcing and venture capitalism- there are multiple ways to acquire funding for your fintech service.

You could also consider participating in a startup competition or seeking financial support from family and friends.

Irrespective of the funding option you select, it is necessary to have a prototype ready for your potential investors.

This will automatically help you, develop a visual prototype that can help you create an impressive pitch deck.

How To Start an Online Fintech Business

The demand for money management technology has only been increasing. This year has been challenging for businesses across various industries. While some entrepreneurs are choosing to wait out before embarking on new ventures, this strategy may not be suitable for the financial sector.

1. Check Demand

The fintech industry offers a range of solutions. From personal management apps to insurance technology and easy investment options, fintech has covered every possible niche.

Consumers are looking for a comprehensive and user-friendly interface that allows them to control their finances on the go.

By launching a fintech startup now, entrepreneurs can tap into the growing demand and attract attention in a market where startups often struggle to stand out.

2. Focus On Expertise

Nowadays, creating a fintech application has become more feasible.

Additionally, programmers can seek guidance from fintech consulting services to gain insight into the intricacies of financial systems.

In addition, most banks and government institutions have embraced the digitalization of the finance industry. They are also gradually adapting their services and operations to support the growth of fintech businesses.

3. Insurtech

Insurance technology or Insurtech has been gaining significant attention in the fintech industry due to its data-driven capabilities. AI tools are everything when it comes to fintech.

It leverages AI to analyze

- criminal records

- medical records

- credit history,

- social media information,

These factors help companies reduce risks while providing the most affordable option to customers.

4. Enterprise Accounting

Creating a fintech startup that caters to businesses can be very profitable. Due to the COVID-19 pandemic, many companies have shifted towards online operations.

Neobanks or online banking services like Karbon Business, Razorpay, and Kodo have revolutionized the fintech industry in the recent past. These rely on the latest technology to improve their processes.

The field of enterprise fintech software is something to look out for as it is highly rewarding.

5. Cryptocurrency

Decentralized applications are increasingly trusted to handle people’s money.

Users search for reliable platforms to manage digital currencies. Despite numerous trading and investment apps available in the cryptocurrency market, none have achieved 100% user satisfaction.

While it may be challenging for a fintech startup to compete with industry giants like Coinbase, creating a well-designed, low-fee, secure app can attract users and build customer loyalty.

Some Successful Examples

1. Stripe

Niche: Online Payments

Funding: $479 M

Stripe is a well-known online payment gateway used by eCommerce businesses worldwide. Unlike PayPal, Stripe focuses on digital businesses rather than consumers.

What sets Stripe apart is its easy integration, which was created to solve the problem of web developers struggling to add a payment system to their sites. Co-founders Patrick and John Collison recognized this issue and made Stripe’s setup as easy as possible, making it a $36 billion fintech giant.

2. Mint

Niche: Finance management

Funding: $31 M

Mint is an app that manages personal finances, offered by Intuit. The app combines several services, such as account management, expense tracking, and budgeting, in one easy-to-use app, eliminating the need for multiple apps.

The success of Mint is attributed to detailed planning, extensive market research, and effective content marketing.

Unlike social apps that often go viral, Mint did not follow an iterative development approach. Instead, the founder, Aaron Patzer, before the app’s launch focused on perfecting the app.

The company also invested heavily in producing credible and useful content, such as articles and infographics, and highlighted the app’s security features to reassure users.

3. Robinhood

Niche: Trade and Investments

Funding: $539M

Robinhood is a popular investment app that offers commission-free trading of stocks. The app makes money through interests from stocks and cash holdings. Additionally, their premium account is a good source of income.

It is particularly popular among millennials due to its personalized features and marketing strategies that cater to their needs and values.

With a user-friendly interface and no commission fees, Robinhood has become one of the top fintech apps in the market.

4. Oscar Health

Niche: Insurance

Funding: $892.5M

Oscar Health is a prominent example of the insurance market – insurance technology.

Unlike traditional health insurance solutions, this is a new type of health insurance company that is customer-centric, straightforward, and affordable.

As a fintech startup, creating a healthcare application that appeals to users can be challenging. Most similar services focus on selling the most expensive plans and limit customer information. This approach can make electronic healthcare seem like a necessary evil.

Oscar Health is different, with a strong user-first approach. The company provides teams of health advisors who help customers select the most affordable insurance options.

The app allows users to store their medical records, and lab reports, book appointments and get virtual health advisories.

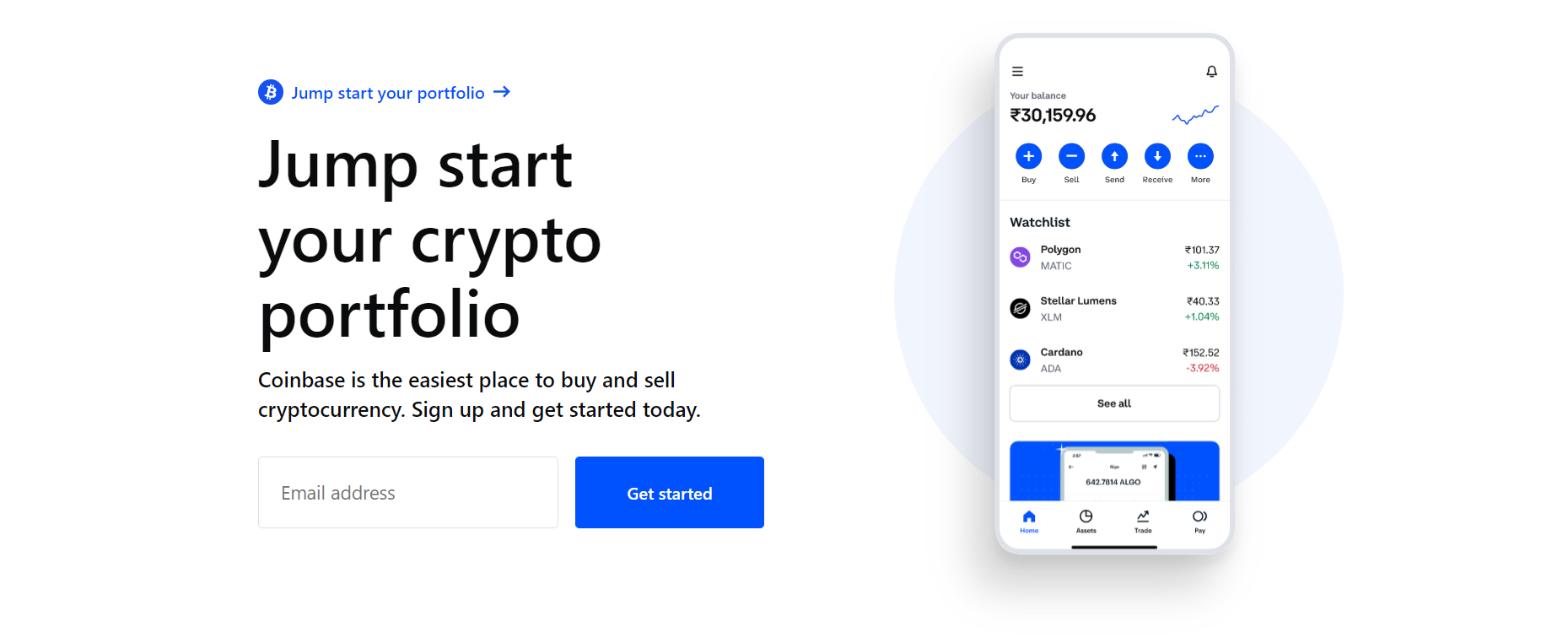

5. Coinbase

Niche: digital currency exchange

Funding: $225 M across 8 rounds

Coinbase is a popular platform for buying and selling digital currencies like Bitcoin, Ethereum, and Litecoin online.

For a fintech company that deals with cryptocurrency transactions, transparency, accessibility, and affordability are essential. Coinbase meets all three criteria.

Operating smoothly in 102 countries with a quick and seamless registration process, users also enjoy high-level security and the platform’s clear adherence to legal compliance policies.

Final Thoughts: How to Start an Online Fintech Business

Keep in mind: Do it once and do it right!

To start developing a fintech startup, it is crucial to have all the necessary aspects in place. However, it is highly recommended to start with a minimum viable product (MVP) first.

It is also important to avoid common pitfalls when creating an MVP.

This involves building the minimum scope of features to test the idea. Gathering users’ feedback to make improvements is the next crucial step.

Starting small and gradually growing the product is a smart approach, especially in the highly competitive fintech market.

Happy Financing!

This is a guest post written by Ramitha Ramesh

Ramitha Ramesh is the editor at Karbon Business, renowned for her expertise in SEO content marketing strategy for a diverse clientele across the US, UK, and India. With a penchant for exploring the fast-paced realm of finance, business, and banking, her blog is a treasure trove of insights that offer unique perspectives on the latest trends and developments in the industry. Finding nirvana in food, fun, and travel, she is on a mission to counter the infodemic of the digital world.

You can connect with her on LinkedIn.

If you want to submit guest posts to Inuidea, check out the guest post guidelines for Inuidea.com.

If you have any questions or if you wanna work with me, feel free to contact me. I’m always available to help young hustlers like you!

I appreciate how the article not only covers the technical aspects of setting up a fintech business but also emphasizes the importance of customer-centricity and innovation in the digital financial landscape. Kudos to the author for providing valuable insights and actionable tips, making it a must-read for aspiring entrepreneurs looking to make their mark in the fintech industry!

Thank you so much for your supportive comment!